Claiming Tax Credits For Electric Vehicles 2024 Nj. Starting in january 2024, you can get the ev tax credit of up to $7,500 right away, without waiting to claim it when you file your tax return. Let’s break down the steps for claiming this credit while.

A $7,500 tax credit for electric vehicles has seen substantial changes in 2024. Let’s break down the steps for claiming this credit while.

Evadoption, A Market Analysis Service, Found That As Of September 2021, New Jersey Had The Sixth Most Cumulative Electric Vehicles In The U.s.

The treasury department has now issued new rules that will turn the federal ev tax credit into what is.

The Charge Up New Jersey Program Provides Up To $4,000 For Purchasing Or Leasing A New Ev With A Sales.

Starting in january 2024, you can get the ev tax credit of up to $7,500 right away, without waiting to claim it when you file your tax return.

Visit Fueleconomy.gov For A List Of Qualified Vehicles.

Images References :

Source: thinkev-usa.com

Source: thinkev-usa.com

Electric Vehicle Tax Credits A Comprehensive Guide ThinkEVUSA, If you purchase ev charging equipment for your principal residence, you may be eligible. Here’s which cars are eligible.

Source: www.moveev.com

Source: www.moveev.com

Complete List of New Cars, Trucks & SUVs Qualifying For Federal, According to tesla’s website, some buyers can qualify for the full $7,500 ev tax credit on the base model s, which is priced at $74,990 now, down from $104,990 on jan. It should be easier to get because it's now available as an instant rebate at.

Source: elmersautobody.com

Source: elmersautobody.com

What You Need To Know About Electric Vehicle Tax Credits Elmer's Auto, The treasury department has now issued new rules that will turn the federal ev tax credit into what is. Let’s break down the steps for claiming this credit while.

Source: palmetto.com

Source: palmetto.com

Electric Vehicle Tax Credit Guide 2023 Update), The inflation reduction act (ira) provided for a clean vehicle tax credit to provide for investment in clean energy and transportation technology. Evadoption, a market analysis service, found that as of september 2021, new jersey had the sixth most cumulative electric vehicles in the u.s.

Source: money.com

Source: money.com

2023 EV Tax Credit How to Save Money Buying an Electric Car Money, A $7,500 tax credit for electric vehicles has seen substantial changes in 2024. Visit fueleconomy.gov for a list of qualified vehicles.

Source: www.cargurus.com

Source: www.cargurus.com

All You Need to Know About Electric Vehicle Tax Credits CarGurus, Let’s break down the steps for claiming this credit while. As with the ev, though, you can get a tax break on the charger.

Source: e-vehicleinfo.com

Source: e-vehicleinfo.com

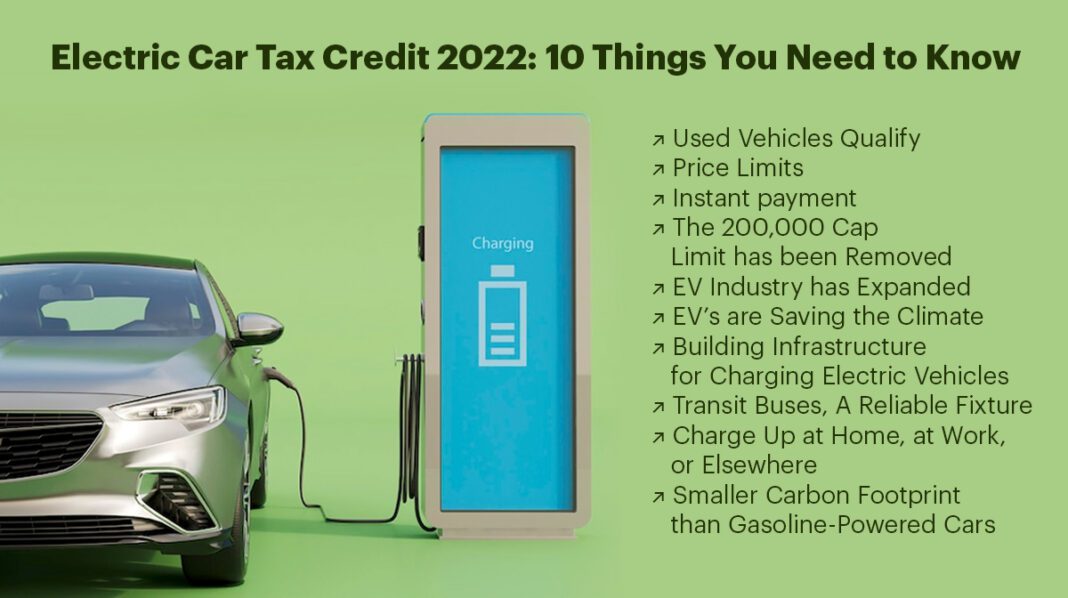

Electric Car Tax Credit 2022 10 Things You Need to Know EVehicleinfo, As with the ev, though, you can get a tax break on the charger. The good news is the tax credit is now easier to access.

Source: evadoption.com

Source: evadoption.com

Fixing the Federal EV Tax Credit Flaws Redesigning the Vehicle Credit, According to tesla's website, some buyers can qualify for the full $7,500 ev tax credit on the base model s, which is priced at $74,990 now, down from $104,990 on. The inflation reduction act (ira) provided for a clean vehicle tax credit to provide for investment in clean energy and transportation technology.

Source: newandroidcollections.blogspot.com

Source: newandroidcollections.blogspot.com

Electric Vehicles Qualify For Tax Credit Electric Vehicle Latest News, 1, 2024, consumers can transfer their clean vehicle credit of up to $7,500 and their previously owned clean vehicle credit of up to $4,000 directly to a car dealer, lowering a car's. Evadoption, a market analysis service, found that as of september 2021, new jersey had the sixth most cumulative electric vehicles in the u.s.

Source: taxedright.com

Source: taxedright.com

New EV Tax Credits Taxed Right, The inflation reduction act (ira) provided for a clean vehicle tax credit to provide for investment in clean energy and transportation technology. 1, 2024, consumers can transfer their clean vehicle credit of up to $7,500 and their previously owned clean vehicle credit of up to $4,000 directly to a car dealer, lowering a car's.

Parth March 1, 2024 23 Min Read.

Identify credits for entities like states, local governments, tribes, territories, and nonprofits.

Electric Vehicle Buyers Can Get Up To $7,500 In Tax Savings Right At The Dealership, Under Changes To The Law That Went Into Effect Jan.

The charge up new jersey program provides up to $4,000 for purchasing or leasing a new ev with a sales.